oil prices

-

OPEC’s tough year: A quarter of oil’s value lost

SHANA (Tehran) – OPEC’s oil basket ended 2025 down 24% from the previous year after a period of sharp volatility.

-

OPEC’s oil earnings dip—but not for four members

SHANA (Tehran) – OPEC data shows Iran’s oil export revenue increased by 14% in 2024.

-

Oil prices drop 10% last week

SHANA (Tehran) – Oil prices, which had recently surged to a five-month high amid escalating tensions between the Israeli regime and Iran, fell by about 10% last week as hostilities subsided.

-

Easing tensions calm oil prices

SHANA (Tehran) – The decline in oil prices following the announcement of a ceasefire reflects the global market's realism, according to an energy expert.

-

Trump tells everyone to keep oil prices down after Iran attacks

SHANA (Tehran) – US President Donald Trump expressed a desire on Monday to see oil prices kept down amid fears that the aftermath of the attacks on Iran's nuclear facilities could cause them to spike.

-

Oil prices ease as Iran-Zionists conflict enters sixth day

SHANA (Tehran) – Oil prices eased in Asian trade on Wednesday, after a gain of 4% in the previous session, as markets weighed the chance of supply disruptions from the Iran-Israel conflict against a U.S. Federal Reserve rates decision that could impact oil demand.

-

Oil rises as Iran-Zionists conflict keeps floor under prices

SHANA (Tehran) - Oil prices rose on Tuesday, with analysts saying that uncertainty would keep prices elevated, even as there were no concrete signs of any production losses stemming from the Iran-Israel conflict.

-

Oil soars more than 6% after Israel's strike on Iran alarms market

SHANA (Tehran) – Oil prices jumped more than $4 a barrel on Friday, hitting their highest price in almost five months after Israel struck Iran, dramatically escalating tensions in the Middle East and raising worries about disrupted oil supplies.

-

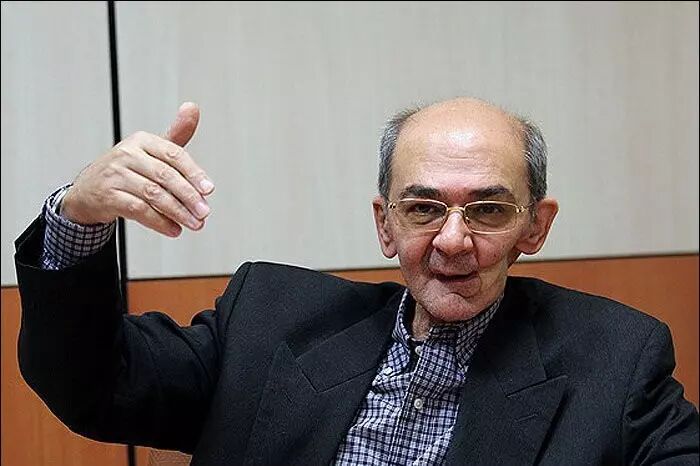

Expert warns of market instability following OPEC+ production move

SHANA (Tehran) - The former director of international affairs at the National Iranian Oil Company warned of the consequences of a recent decision by eight OPEC+ member countries, cautioning that instability could return to the oil market.

-

‘Increased oil supply alone won’t lower prices’

SHANA (Tehran) – Morteza Behrouzifar, a faculty member at the Institute for International Energy Studies, said the recent decision by eight OPEC+ member countries to increase oil supply will not significantly reduce prices in the short term—barring a widespread global economic recession—unless geopolitical and economic stability persists.

-

-